The heuristics often described in behavioral economics offer insightful frameworks for understanding mainstream resistance to Bitcoin.

This is an opinion editorial by Rich Feldman, a marketing executive, author and advisory board member at Western Connecticut University.

Behavioral economics has long been cited to describe our “irrational tendencies” as consumers and investors. I’m here to extend that discussion specifically to Bitcoin because, let’s face it, when it comes to crypto in general and Bitcoin specifically, the influence of emotions, biases, heuristics and social pressure in shaping our preferences, beliefs and behaviors is profound… and fascinating.

Page Contents

Getting Beyond FOMO

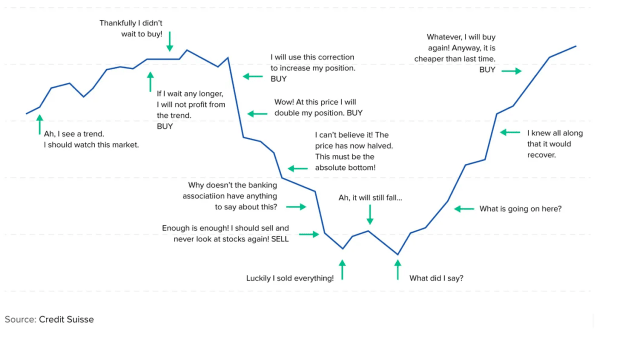

As is preached in behavioral finance, investing in anything is prone to common “traps” such as fear of missing out (FOMO), loss aversion, groupthink (“the bandwagon” effect) and the sunk-cost fallacy — which account for people holding onto their investments longer than they should.

Cognitive journeys such as these are nicely demonstrated in the chart below which, ironically, was created by Credit Suisse. In light of recent events, perhaps it should’ve been wary of “overreach bias!” But let’s not kick it while it’s down.

Concepts of behavioral finance and Bitcoin certainly have interesting parallels. For example: FOGI (not the “old” type), or fear of getting in. Chalk that up to a nascent trading marketplace which can be incredibly confusing and (for many) require a technological leap of faith.

Yet, anyone who thinks this is a new phenomenon need only look to the launch of online banking, bill pay and mobile deposits to know that there is hesitancy around every consumer foray into new technologies, particularly as they evolve. As such, FOGI paralyzes the “crypto curious” from making the behavioral moves (aka, learning and discovery) required to actually participate in the asset class.

Moreover, recency bias can certainly help explain much of the gyrations of the Bitcoin ecosystem. With so many major advances, disruptions and “seizures” capturing headlines seemingly every day, it’s no surprise that this irrational tendency to assume that recent events will all but certainly repeat themselves can easily be associated with a volatility that can seem ever present.

With access to a 24-hour market, this is only exacerbated, amplifying the peak-end rule in which the most recent and intense positive or negative events (or “peaks”) weigh most heavily in how we remember how certain things were experienced — thus having the potential for undue influence on near-future decisions.

Temporal Discounting And The YOLO Effect

But of all the biases and heuristics that I think help explain the mainstream perception of Bitcoin today, it’s temporal discounting — which is our tendency to perceive a desired result in the future as less valuable than one in the present — that is most prescient. Add onto that the YOLO effect — “you only live once” hedonism and future “blindness” — to the mix, and you have a powerful crypto cocktail.

Here’s why.

It’s human nature for those who say, “I can’t see where this is going” — particularly those in the “there’s no there, there” camp — to not try to envision where it’s going. Focused on the present, they look to frame something that exists solely based on what they can identify, interpret and internalize now.

These are the same types of folks who, when cell phones were first introduced, asked “why do we need this?” They simply couldn’t foresee mobile technology lifting developing nations, becoming central to an entire payments industry, fundamentally altering telecommunications and so on. This is not to disparage these people; temporal discounting is commonplace. In fact, you can chalk this phenomenon up to the woeful rate of retirement savings among a wide swath of the population.

An inability to imagine the future, or simple disinterest in doing so, leads to a desire to create shortcuts in understanding and explaining the “why?” Combined with the “illusion of control” heuristic — or belief that we have more control over the world than we actually do — there is no appetite for a leap of faith or trust that, in the technology, there is a world of promise.

‘The Old New Technology’ Narrative

Another interesting psychological perspective can be summed up this way: Bitcoin was introduced to the world in January 2009 by Satoshi Nakimoto. At that point, it was a groundbreaking, revolutionary idea. But, now, there are literally thousands of blockchain protocols and projects — many of which have leaped past Bitcoin in their utility and promise.

Or, put another way, Bitcoin is old new technology. A form of the availability heuristic, it captures our tendency to bias information that we conjure up quickly and easily to frame an opinion.

Proponents of this point of view will point to Bitcoin’s rejection of the proof-of-stake consensus mechanism (and the myriad reasons for that), a centralization of mining power and smaller developer community compared to others.

Opponents of this point of view have to laugh. Fourteen years is hardly “old.” The technology has withstood the test of time rather admirably compared to others, and innovation on the blockchain continues to march forward with cross-chain bridges, Ordinals, the Lightning Network, etc. In fact, it’s Bitcoin’s stability, permanence and security that has kept it at the forefront of this emerging ecosystem.

In short, when you’re first, you’re inevitably compared to everything.

The Inflation-Hedge Confirmation Bias

For quite some time, the narrative around bitcoin as an investment was that it was “a hedge against inflation.” “Digital gold,” if you will.

Many would argue that this prevailing wisdom has been debunked — at least for now. In reality, what it is, and should have always been viewed as, is a hedge against systematic institutional failure. After all, the very idea of Bitcoin was born out of a prior financial crisis. As of this writing, when banks like Silicon Valley Bank (SVB), Credit Suisse and Silvergate have come under extreme duress, Bitcoin is showing its mettle.

That the inflation-hedge narrative took off in such a big way is an example of confirmation bias — or our tendency to favor existing beliefs. That the original raison d’etre for Bitcoin was shoved aside (by some), can be attributed to optimism bias. People simply continue to underestimate the possibility of experiencing negative events.

And even if there isn’t a catastrophic systematic implosion, the mere potential of one opens the door to give this new store of value a vast new footprint.

Bit Bias

When it comes to Web 3, crypto, blockchains and Bitcoin, I can admit to having bit bias. That can be chalked up as a belief that the fundamental attributes of Bitcoin technology — decentralization, self custody, ownership and control — will morph in ways we cannot fully comprehend today.

Put another way, if you think “there’s no there, there,” perhaps it’s because you just can’t imagine what the “there” could be.

Irrational? Let’s talk 10 years from now.

This is a guest post by Rich Feldman. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.